AMD’s Pullback Looks More Like a Pause — And Nvidia’s Beat May Be the Turning Point

AMD slipped ahead of Nvidia’s earnings, and that nervous positioning made sense: when one company effectively defines the AI hardware economy, the entire sector trades…

PayPal Pay in 4 Arrives in Canada for the Holiday Rush

There’s a familiar rhythm to November in Canada: the first real cold snaps, the early darkness, and that gradual drumbeat toward Black Friday, Cyber Monday,…

NuScale Power: The SMR Bet Moves From Concept to Commercial Deployment

The latest quarter for NuScale Power reads less like a standard earnings update and more like the moment a long-promised technology finally steps onto the…

The Waiting Game at the Bank of England

There’s a kind of quiet tension in the air whenever the Bank of England edges near a rate decision. You can almost picture a long…

Maersk Q3 2025: The Quiet Rebuild of a Global Trade Powerhouse

There’s a subtle shift running through Maersk’s latest results, something steadier than the volatility of the last few years. The headline numbers show a company…

Tempus AI: Scaling Into an Inflection Point

Tempus delivered the kind of quarter that forces you to reconsider where the company sits in its maturity curve. Revenue in Q3 2025 grew 84.7%…

Palantir’s Explosive Q3: When “AI Leverage” Becomes a Revenue Machine

Palantir’s Q3 2025 numbers read like a victory lap for the AI-driven enterprise software thesis. The Denver-based company once dismissed as a defense contractor in…

Nexperia, China, Netherlands: A Semiconductor Flashpoint in Europe’s Geopolitical Balancing Act

The clash between the Dutch government and China over Nexperia has rapidly evolved from a corporate governance issue into a defining episode in Europe’s broader…

Jensen Huang and the AI Virtuous Cycle: The Economics of Infinite Acceleration

Jensen Huang has a knack for turning technical revolutions into elegant economic metaphors. His recent claim that artificial intelligence has entered a “virtuous cycle” isn’t…

Cloudflare’s Q3 Beat, Reacceleration, and the Quiet Cash Engine Powering the “Connectivity Cloud”

Cloudflare’s stock shot up roughly nine percent in after-hours trading—an instant market endorsement of a quarter that finally matches its CEO’s relentless optimism. Revenue rose…

Qualcomm’s Bold AI Gamble: Taking on Nvidia and AMD in the Data Center

Qualcomm shook the semiconductor world with the announcement of its AI200 and AI250 accelerators, aimed squarely at the booming AI data-center market. For a company…

CoreWeave’s Monolith AI Deal: What It Means for NVIDIA Shareholders

The CoreWeave–Monolith AI acquisition is not just a strategic step for CoreWeave, it’s also a subtle but important signal for NVIDIA shareholders. NVIDIA has a…

Anthropic, Deloitte, and the Normalization of AI in Corporate Workflows

Anthropic’s landmark deal with Deloitte isn’t just about one company signing a big contract. It’s a signpost of something larger: AI moving from pilot projects…

AMD’s Leap from Challenger to Established AI Power

For years, the narrative around artificial intelligence hardware has revolved around two familiar titans: Nvidia and Broadcom. Nvidia built its dominance by transforming the GPU…

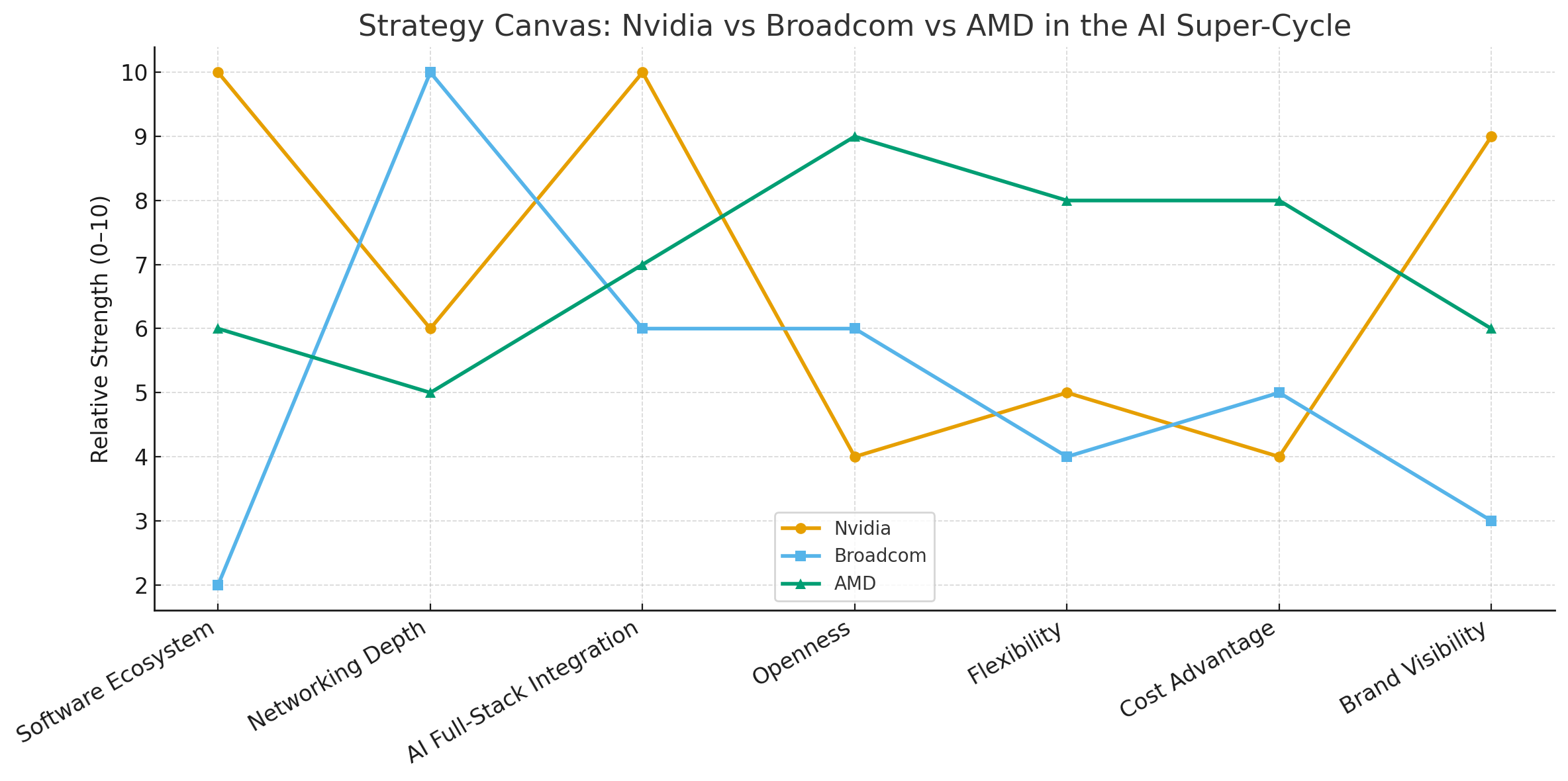

Nvidia, Broadcom, and AMD: Mapping the Next Blue Oceans in the AI Super-Cycle

The AI super-cycle has thrust semiconductors into the center of global strategy, turning companies like Nvidia, Broadcom, and AMD into household names. All three compete…

European IPO Crown Goes to Stockholm

The golden crown in the foreground of this photograph gleams in the morning light, its polished surface catching the sun as if it had been…

Chinese Travel Equities Slip as Golden Week Data Disappoints

Chinese travel-related equities slid after the Ministry of Transport released its early Golden Week data, which Citi analysts described as weaker than expected. The first…

When Professions Meet Automation: A Map of Displacement, Adaptation, and Renewal

The central misunderstanding about “AI takes jobs” is that it treats an occupation as a single, indivisible block. Professions are bundles of tasks knit together…

Electronic Arts’ Historic Buyout Buzz Sparks Market Frenzy

Electronic Arts (EA) shares surged roughly 15% after The Wall Street Journal revealed that the video game giant is nearing an agreement to be taken…

Intel Surges on Apple Investment Speculation and Nvidia Partnership Momentum

Intel’s shares climbed sharply today, extending a rally that has been gathering steam over the past week, as investors digested reports of a potential investment…

Accenture’s AI Paradox: Growth in Bookings, Decline in Stock

Accenture’s latest earnings report for fiscal year 2025 illustrates the paradox at the heart of today’s consulting industry. On the surface, the numbers suggest a…

NVIDIA: From Chipmaker to AI Infrastructure Powerhouse

The newly announced 10 gigawatt strategic partnership between NVIDIA and OpenAI marks a decisive turning point in the AI era. It is not simply another…

H-1B Visa Uncertainty Casts a Shadow on Nasdaq Tech Stocks

The announcement of a massive $100,000 fee on new H-1B visa applications has already rippled across global markets, but its most sensitive fault line runs…

Why Nvidia’s $5 Billion Bet on Intel Could Only Happen Under Washington’s Shadow

The semiconductor industry is no stranger to strange bedfellows, but few scenarios would raise eyebrows more than Nvidia investing $5 billion into Intel. On the…